The Backlog: Product-Market Fit and Monetization; The Symbiosis of Horizontal and Vertical Markets

Two short posts on topics that I’m ruminating on

As I mentioned in Tuesday’s post, I’ll occasionally send it out shorter posts on topics that I’ve been thinking about it, but aren’t long reads. These posts will be titled The Backlog (I’m a PM after all). They will be more evergreen and foundational in nature. Onto today’s post!

———

Product-Market Fit and Monetization

I think how our understanding product-market fit needs to change.

If customers want your product, but what they are willing to pay for AKA what you can charge can’t support the business’s operations, you don’t have product-market fit.

Monetization and unit economics ARE parts of the product.

I. B2C vs. B2B Monetization

A business should eventually be self-sustaining because that shows a healthy business, leverage over supply and true market power (inelastic demand).

Figuring out monetization seems to be less of an issue in B2B than B2C because in IMO B2B companies have defined problems that they’re solving, directly impacting a financial outcome for their customers.

B2C problems are usually grounded in behaviors that are monetizable via ads, direct payment (DTC, subscriptions, etc.), money movement fees or a combination of these monetization methods. Behaviors change though, making product-market fit (including monetization) an ever-evolving proposition.

II. Problems and Opportunities

B2C problems aren’t always problems – there are often opportunities to remove friction in transactions, trade attention for entertainment or knowledge, or express an identity (real or perceived).

The biggest B2C opportunities combine two or all three types. Again, these things are subject to change with time, culture and host of other external factors. This means B2C product-market fit is more art than science.

For B2B companies, monetization and unit economics are an easier calculation: ops/admin + headcount (tech + biz + people ops) <Σ(pricing X customer accounts across plan tiers).

———

The Symbiosis of Horizontal and Vertical Markets

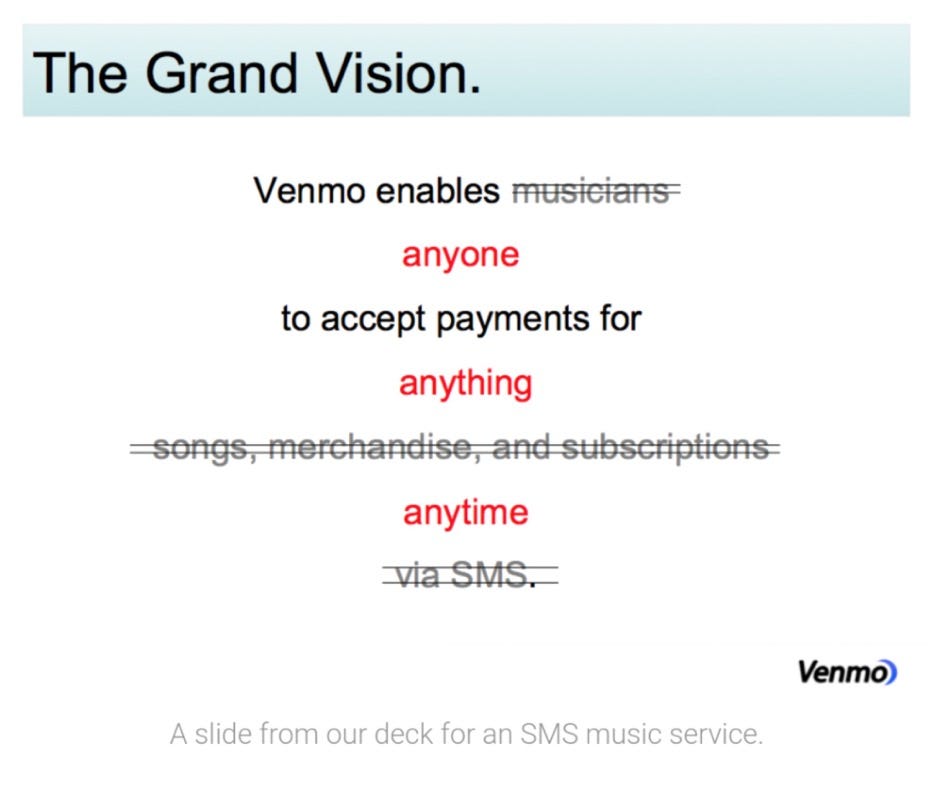

I found a recent tweet about Venmo’s origin story super interesting. This image, in particular, from Venmo’s pitch deck got me thinking there might be a symbiotic relationship between horizontal and vertical commerce markets.

I. Horizontal Growth begets Vertical Opportunity

Horizontal e-commerce marketplaces like eBay and Amazon created a path for vertical e-commerce software providers like Shopify, BigCommerce and Square to thrive because Amazon, Ebay created significant consumer demand (and expanded the total e-commerce TAM).

This incentivized vertical e-commerce software providers to build solutions to support suppliers not only selling on their own e-commerce store, but on horizontal marketplaces like Amazon and eBay.

Vertical e-commerce software for suppliers (Eg. Toast and BentoBox for restaurants, Slice for Pizza delivery, etc.) work best when there is significant demand created by horizontal foundations and shifts, like the growth in the food delivery marketplaces.

If I had to guess, Toast (pre-pandemic) was growing in parallel with online food ordering services (delivery + pickup). Food and grocery delivery apps expanded the market of people ordering food online, which counter-intuitively grew total demand for restaurants (including indoor dining).

II. HAMs and the New Creator Economy

This symbiosis thesis even seems to bear out in non-traditional e-commerce markets like subscriptions. The continued growth of social media platforms like YouTube, TikTok and Instagram, which are horizontal attention marketplaces or HAMs, are creating massive attention demand (ie. value creation) and opportunity for value capture.

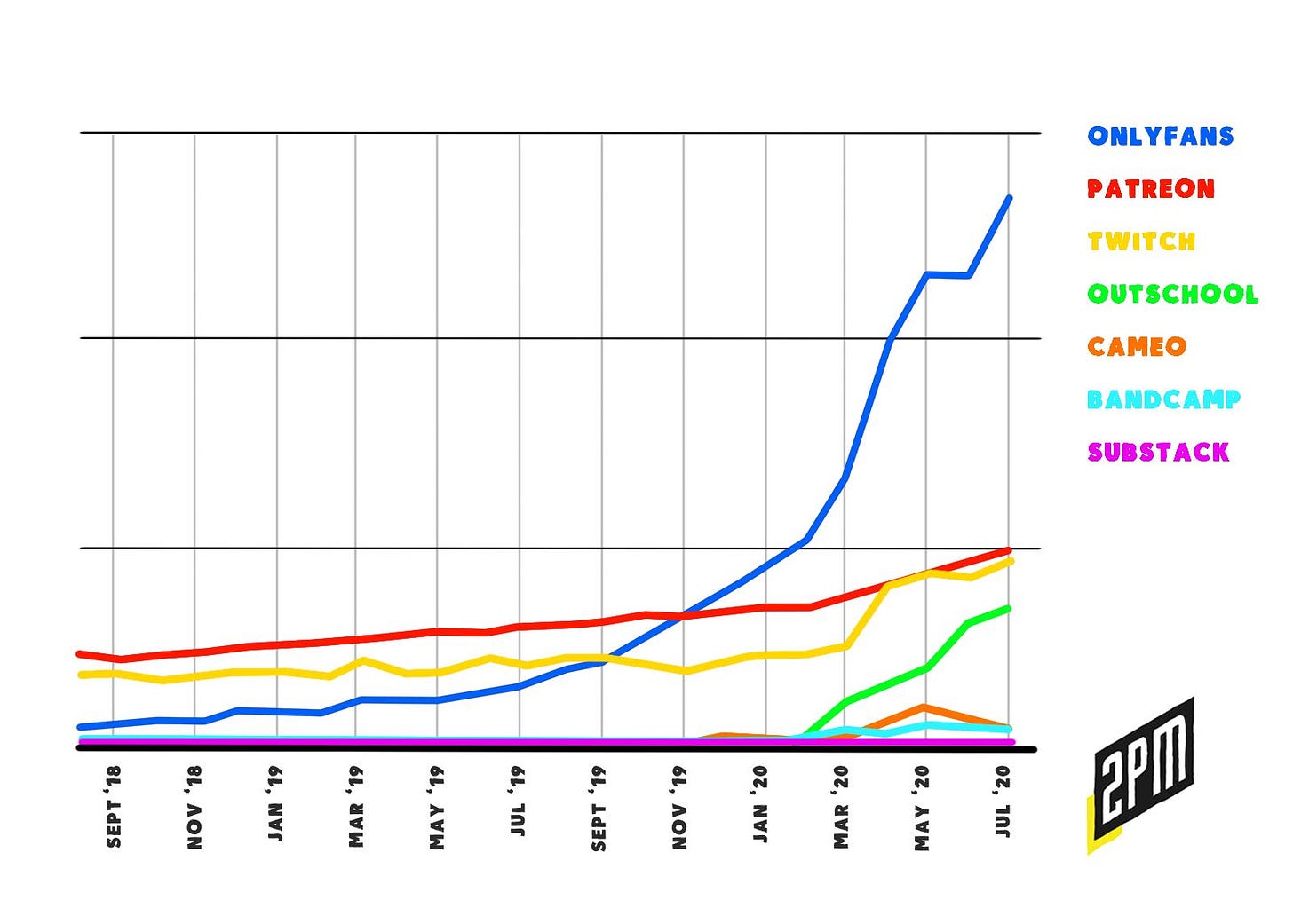

Vertical software providers like Substack, OnlyFans, Patreon, and others provide software tools that help suppliers (ie. prominent accounts on HAMs) directly monetize their attention and followings. This graph from 2PM illustrates the revenue growth for these vertical software providers during the Covid pandemic.

In my next post, I’ll dive deeper into vertical software how embedded fintech may play significant role in the resurgence of local restaurants.