The Attention Tax

Facebook isn’t the WeChat of the West and that’s a great thing for the company.

*Editor’s note: I wrote this post in 2017*

On a recent Recode Decode podcast, David Marcus, Facebook’s Head of Messenger, stated what should be an obvious assessment of how Facebook plans to monetize Messenger:

“If we drive business outcomes at a higher rate, then those businesses will want to open more of these conversations and, as a result, will buy more ads to open these conversations.”

I note that Marcus’s assessment should be obvious because, in reality, it hasn’t been all that obvious to outside tech and payments observers. Case in point, this February 2017 article from Banking Innovation:

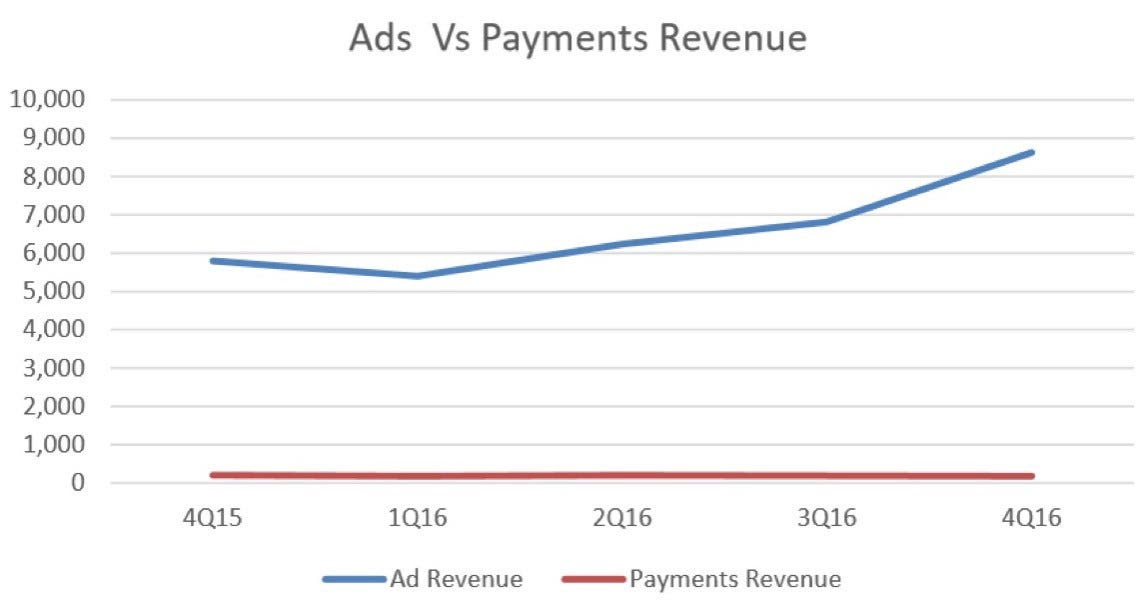

Facebook’s payments revenue has been on a steady decline since users stopped obsessing over desktop video games like Farmville and Cityville. Will we ever see the social media giant revive that revenue stream?… Facebook still insists that it’s not a “payments company,” even after receiving a payments license in Europe in December. Payments revenue past quarter was down 12% to $180 million compared to last year. In comparison, ad revenue was at $8.6 billion, up 53% (!) from the previous quarter.

In the quote above, there is much emphasis put on the fact that Facebook received an European payments license and how that belies Facebook’s claim that it’s not a “payments company.” If it wasn’t clear enough that Facebook’s claim is correct, the fact that ad revenue in Q4 2016 was $8.6 billion to $180 million in payments revenue should clear up any confusion. I highlight this article to illustrate how there is still a fundamental misunderstanding of Messenger’s business model, regardless of Facebook’s attempts at clarification.

Some of the misunderstanding may stem from the fact that Marcus was previously the president of PayPal. Facebook slowly introducing commerce features and initiatives into Messenger’s business messaging platformhas surely been a contributing factor as well. While these two factors have affected perceptions of Messenger’s business objectives, neither have impacted perceptions in tech circles more than the “WeChat of the West” moniker.

Why Messenger isn’t WeChat of the West and That’s A Good Thing

I would be remiss without acknowledging the obvious: Messenger’s bot platform and early commerce initiatives have been heavily-influenced by WeChat’s dominance in China. As I noted in Commerce in a Message, Facebook’s early Bot platform efforts didn’t take advantage of what actually made WeChat a great user experience:

A mobile web view is the best UI for most B2C messaging because of the dynamic actions that users can take. Text-based B2C messaging is too constraining for most B2C transactions, whether it’s a human or brand bot on the other end. Web views take advantage of the context provided by message apps — ID, payment credentials, messaging history — in a way that provides a more satisfying and useful user experience.

Facebook would eventually incorporate web views into Messenger, allowing developers to build more dynamic B2C interactions in the app (whether bot, webview or a combination of the two). While Facebook launched with the wrong UX (IMO) for Messenger commerce, it wasn’t an unreasonable decision and speaks to the inherent differences between WeChat and Facebook. There are many differences, but the most important is WeChat’s B2C supremacy in China’s mobile app ecosystem. It’s unparalleled, even by Facebook.

WeChat has penetrated every aspect of consumer life in China, amassing 900 million monthly active users (MAUs) and millions of businesses that use their official accounts to interact with users. For many businesses in China, WeChat serves as their website, customer service channel, and payments processor, reaching a level of infrastructure integration unheard of in the Western internet economy.

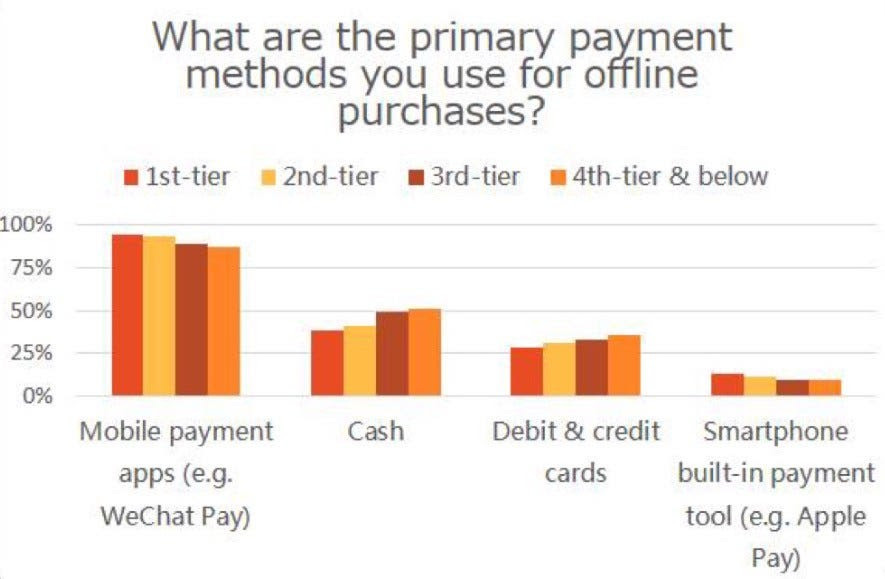

For millions of WeChat users, the app represents a trusted payments credential for commerce. For both users (especially in Tier 1 cities) and businesses, WeChat Pay’s utility solves real needs like avoiding counterfeit bills.

Image: WeChat User and Business Ecosystem Report

Unlike China, the West has a more mature and diversified internet economy. For all of Facebook’s dominance, it’s still not at WeChat’s level. That maturity and diversity means that mobile app engagement and retention is extremely hard and costly for most businesses and brands. This has been a tremendous opportunity for Facebook and Google (the other half of the digital advertising duopoly), serving as the mobile middlemen between brands and consumers in Facebook’s apps and in Google searches. More on this later.

This is why Facebook’s initial bot platform strategy was more than defensible. Facebook, at least to an outside observer, is focused on creating scalable and elegant user experiences that can be leveraged as a point of engagement and conversion by its millions of advertising partners. Scale and efficiency for millions and billions is the name of Facebook’s game. Combine that with the increasing importance of artificial intelligence layers in consumer technology, and you realize that Facebook’s original bot strategy was justifiable at the time.

The main issue here is that Messenger currently serves as a communications channel in Facebook’s app constellation (Messenger, Instagram and WhatsApp). This is a very different purpose and job-to-be-done from the all-in-one utility of the core Facebook app, or even WeChat’s OS-within-an-OS platform position. Attempting to create a WeChat-like platform in Messenger will require significant infrastructure building to increase the app’s utility, hence Messenger’s platform growing pains. Furthermore, Facebook can’t recreate the WeChat user experience because it doesn’t have the infrastructure and established consumer behaviors in place that WeChat has today (See the meteoric rise of QR code usage in China) or the lack of infrastructure and expectations in consumer UX (i.e. mobile payments and online advertising) that WeChat lucked into years ago.

Taxing Attention

Even with the necessary infrastructure in place, Messenger’s platform opportunity is vastly different from WeChat and that’s a good thing! Facebook’s app constellation and place in a mature internet economy presents an opportunity to be a middleman for advertisers to engage and activate consumers in the West who are increasingly difficult to reach. In this landscape, Messenger could serves as highly valuable and useful communications channel for B2C interactions — brand activation, engagement and customer lifecycle management.

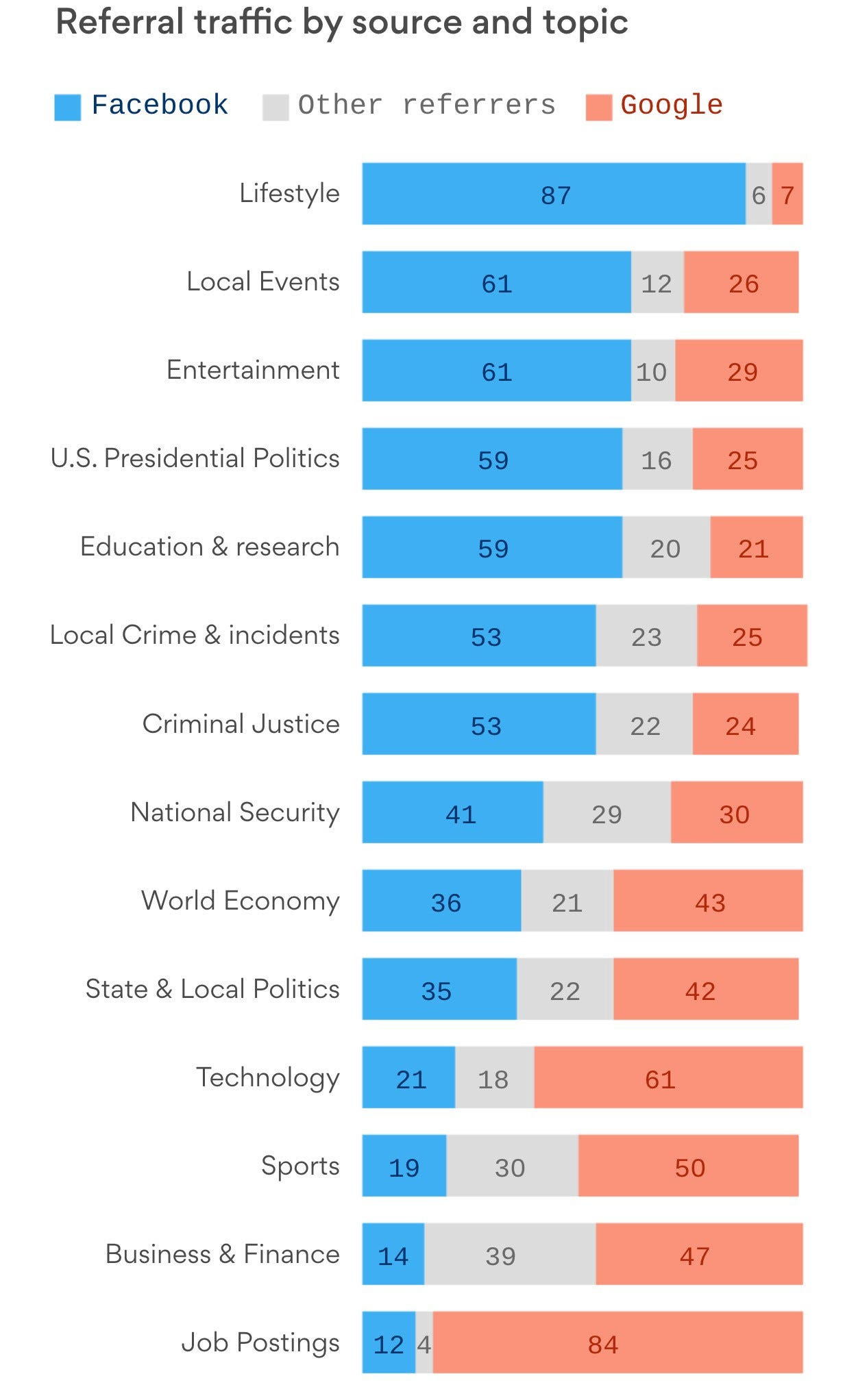

The graphic above highlights the various industries that Facebook and Google drive traffic to. These industries and the publishers in them derive a non-immaterial amount of revenue from Facebook and Google, with conservative estimates of 14% of revenue for publishers. Effectively, Facebook is a tax on various forms of attention. Facebook’s ad-supported business model is incredibly lucrative and is only just starting to be tapped in Messenger.

Payments is a means to an end, with the end being a tax on consumer attention, engagement and retention on mobile devices (and future devices). Advertising is a more valuable business opportunity for Facebook and Messenger than payments, aligns with Facebook’s tried-and-true business model and is a better fit for Messenger’s current infrastructure and level of utility.