Payments, Card Networks and Innovation

Or how to get to 70 Million Venmo users in 10 years

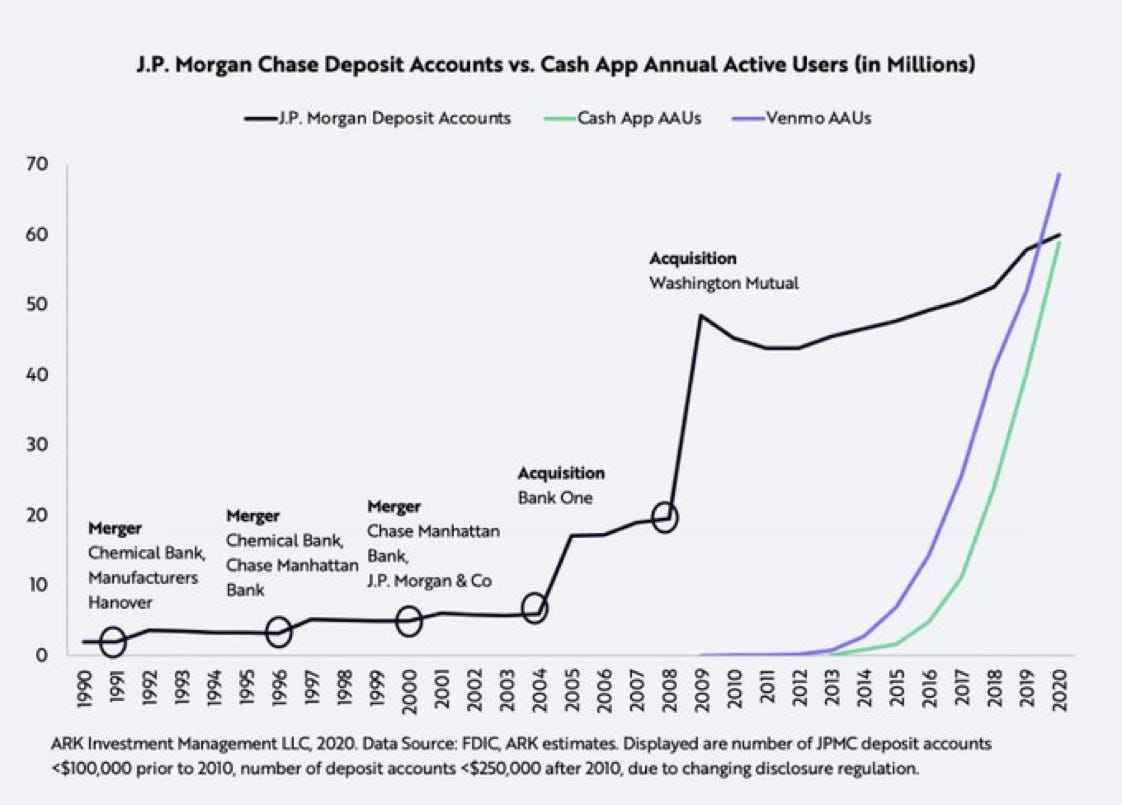

The post below is from February 2017 and this ARKInvest graph is from September 2020:

This 2017 post details the strategy that PayPal used to exponentially grow its services and user base into amazing numbers you see in the graph.

———

Last summer, I wrote about the PayPal-Visa partnership and laid out what I considered to be PayPal’s strategy behind the deal:

The best way to view this situation is through a marketplace perspective. VDEP deal gives PayPal access to more merchants (supply side) to match with consumers (demand side), while taking a cut of merchant transactions. The end goal is undoubtedly give a little now to get a lot (of revenue and profit) later.

Wall Street was characteristically pessimisticabout PayPal’s end of the bargain, declaring Visa to be undisputed winner of the partnership. Much of this pessimism was rooted in a failure to understand why this deal would make sense for PayPal beyond more access to merchants and consumers. Since the Visa deal, PayPal has gone on to strike up a similar deal with Mastercard and has seen its stock price rise and revenues continue to grow. Wall Street is a still bit cautious of PayPal’s stock and performance, but why? It boils down to a fundamental misunderstanding about the payments industry (seen by many as a commodity market), what it takes to innovate in this market and the path that PayPal has paved towards success.

A Cheat Sheet for Understanding Payments

The payments industry has three key factions that make the whole system run as well as it does. Those factions are the payment card networks (dominated by Visa and Mastercard, with American Express a distant third), the banks and the merchants/retailers. The card networks oversee the payment rails (i.e. how payments are processed) that banks leverage when they issue credit cards and debit cards to consumers and businesses. Merchants and retailers use the card networks’ payment rails to transact commerce with consumers. When a consumer buys something from a merchant or retailer, the merchant’s bank requests payment from the consumer’s bank. In order to handle this request, the consumer’s banks charges the merchant bank an interchange fee (at 1.5% + plus 10 cents per transaction). Because the entire transaction takes place on top of the Visa or Mastercard’s payment rails, an assessment fee (at 2.5–3%) is charged to the merchant bank. This process happens every time you swipe or dip your card in-store or input your credit card or debit card information online.

Key Terms to Remember

Assessment Fee: Visa and Mastercard connect banks for the purposes of commercial or P2P (peer-to-peer) transactions. The fee covers the operating costs of managing their network.

Interchange Fee: Fee that banks charge each other to process commercial transactions. The fee covers the cost to issuing banks for offering lines of credit and fraud mitigation.

Payment Rails: Run by Visa and Mastercard; how the magic of payment transactions happen behind the scenes.

So How Do You Actually Innovate in Payments?

Understanding the terms and interactions above is necessary in understanding how the payments ecosystem works and, more importantly, how to innovate in that ecosystem and gain a competitive advantage. There are really only two paths to innovating in payments:

Building on top of credit cards (and the card networks), or

Create a new payment system and the accompanying network to support it.

The first path has been done before (see all retailer mobile wallets or points-based credit cards), is relatively easy to do, but creates no material value created other than having an app icon on a consumer’s smartphone home screen, if you’re lucky. If you’re a major retailer or bank focused on building consumer loyalty, there are worse ways to build that loyalty. However, this path isn’t a differentiator and it certainly won’t give you a competitive advantage that couldn’t be overcome by a determined competitor with a sizeable marketing budget.

The second path, creating a new payment system and network, is incredibly hard to build, but could be infinitely valuable if consumer and retailer/merchant adoption reached critical mass. This is what the original PayPal team tried to create before selling to eBay in 2002. That opportunity never went away and after PayPal spun out from eBay in 2015, the new PayPal has been putting the pieces in place to seize it again. There are many reasons why the original PayPal plan didn’t succeed, but the most important were that it was burning cash on customer acquisition and the internet was just starting to rise to prominence in consumer life. The rise of the consumer internet and, subsequently, mobile has brought down distribution costs and brought billions of people online. Sometimes being early is the same as being wrong, but if you’ve survive along, you just might be proven right.

A Potential Innovation Strategy for PayPal

Fast forward from 2002 to 2017, and you can see that PayPal has the chance to bring real innovation to payments. If the second path is the best way to innovate payments, PayPal is well-positioned.

Payment Network

As of its most recent earnings call, the company has amassed 197 million monthly users. But consumers aren’t enough to win in payments; merchants and retailers have to be on board as well. All of the major payments innovationsrequired ubiquity wherever consumers transactto enable adoption to really take off. With the Visa and Mastercard deals in place, PayPal is set to bring its various mobile commerce offerings to merchants and retailers in-store (accounting for 92% retail transactions) and online, reaching more consumers and steadily approaching ubiquity.

With PayPal headed towards ubiquity, this will allow the company to build relationships with retailers and merchants centered around Braintree’s commerce infrastructure solutions. This also creates an opportunity to offer its platform integrations for platforms like Magento, Demandware and Bigcommerce and Woocommerce, which power many retailers’ desktop and mobile websites.

While many of these merchants and retailers are using legacy systems, the commerce industry is trending towards modernity in both technology infrastructure and UX capabilities. Legacy systems are quickly becoming a liability in the changing mobile commerce and ecommerce landscape. PayPal is well-positioned to provide the modern commerce technology necessary to bring these merchants and retailers up to speed. Having ubiquity at every level of the commerce stack can create significant lock-in for retailers and merchants in the PayPal ecosystem.

Payment System

The payments system necessary to make this strategy work is already in place. PayPal facilitates bank to PayPal wallet transactions running on ACH, the automated clearing house for financial transactions between financial institutions. Remembering our payments cheat sheet above, merchants and retailers incur two separate fees for transactions running on the card networks’ payment rails. This presents PayPal with a significant opportunity to offer merchants a payment experience that incurs no interchange fee if consumers are paying with the PayPal wallet. There would be no merchant bank-to-customer bank transaction, thus no interchange fee. From the PayPal perspective, a PayPal or Venmo wallet payment experience is attractive because ACH fees for bank transfers into a Venmo or PayPal Wallet are 4 cents per $100 transferred. This would give PayPal a higher margin than payments via debit cards or credit cards.

I would be remiss in not pointing out an important stipulation in PayPal’s deals with Visa and Mastercard. The stipulation states that PayPal can no longer prioritize bank accounts or debit cards over credit cards. In exchange for putting all payment sources on equal footing, Visa and Mastercard will remove their digital wallet fee to PayPal. In the past, PayPal had been known to suggest that users link their debit cards and bank accounts to their PayPal wallet in order to avoid assessment fees from the card networks.

In theory, putting all payment sources on equal footing would eat into PayPal’s overall take rate (i.e. the amount of money it keep from each payment made on its platform). In practice, this stipulation works out in PayPal’s favor because the majority of users have linked their bank account or debit cards to avoid PayPal fees. This user behavior has already been established and will be hard to overcome even with the stipulation is in place.

As PayPal moves into physical retail and powering mobile commerce purchases with Venmo merchant services, it plans on charging merchants for transactions. Due to the high number of users with bank accounts or debit cards linked to their PayPal or Venmo Wallet, PayPal is able to avoid both assessment fees and the digital wallet fee. This will allow PayPal to offer a more competitive fee structure to merchants, incentivizing them to join PayPal’s ecosystem of solutions and merchant services. PayPal can make up make the forgone revenue from merchant fees on the back of a high volume of merchants transactions due to the ubiquity and liquidity of its payments network and system.

Over the last year, PayPal has promoted a message of “consumer choice” and its partnerships and product offerings convey a dedication to that message. This dedication could prove very profitable in the coming years.